Mercer Travel Tracking Platform helps organizations identify potential risks they may be facing in each jurisdiction around the world due to the business travels of their employees and take appropriate steps to avoid them. In this sense, the platform can help you:

- Control your business travellers and number of days they stay in each location.

- Analyze and foresee the potential tax and social security risks in home and host countries related to the uploaded trips.

- Gather data and automate preparation of A1 certificates to be filed before the Social Security authorities in home countries.

- Automate the submission of the pertinent posted workers communication if applicable to the labor authorities.

The Mercer Travel Tracking Platform is specifically designed to assist organizations in navigating these complexities. By identifying potential risks associated with employee travel in various jurisdictions worldwide, the platform empowers companies to take proactive measures to mitigate compliance issues.

Mercer Travel Tracking Platform helps manage these risks.

With the Mercer Travel Tracking Platform you can:

Manage employee trips in real time

Generate legal reports for companies and employees

Create trips from any device

Control the compliance obligations of your employees

4 tools, 1 platform

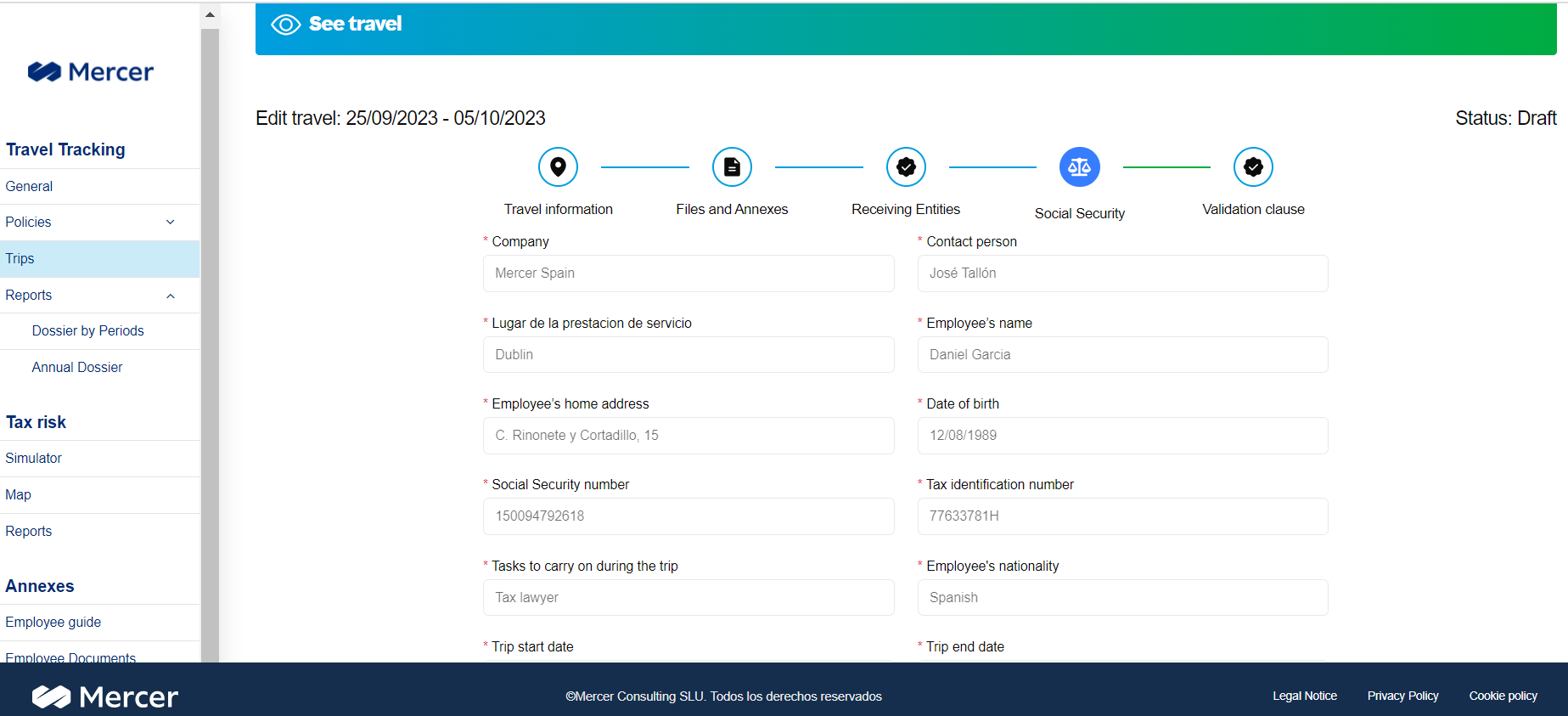

1. Travel Tracking Tool

This tool allows you to:

- Manage all employee trips in real time.

- Fill in trips using any device (tablet, mobile applications on IPhone and Android), this tool is available through the cloud or via software download.

- Generate automated reports for the employee and company.

- Control the tax residence status of employees with respect to their country of origin.

2. A1 – Certificates of Coverage (CoC)

The tool automates the gathering and preparation of A1/CoC to be submitted to Social Security authorities in home country. This implementation reduces significantly administrative burden, streamlines the legal compliance obligations and minimizes errors.

3. EU Posted Worker Directive

The tool ensures compliance with EU directives by identifying the requirements of each country for business trips of the planned duration, based on EU regulations and bilateral agreements between home and assignment country. The tool automates the notification to pertinent social security authorities and provides documentation of fulfilling these legal obligations.

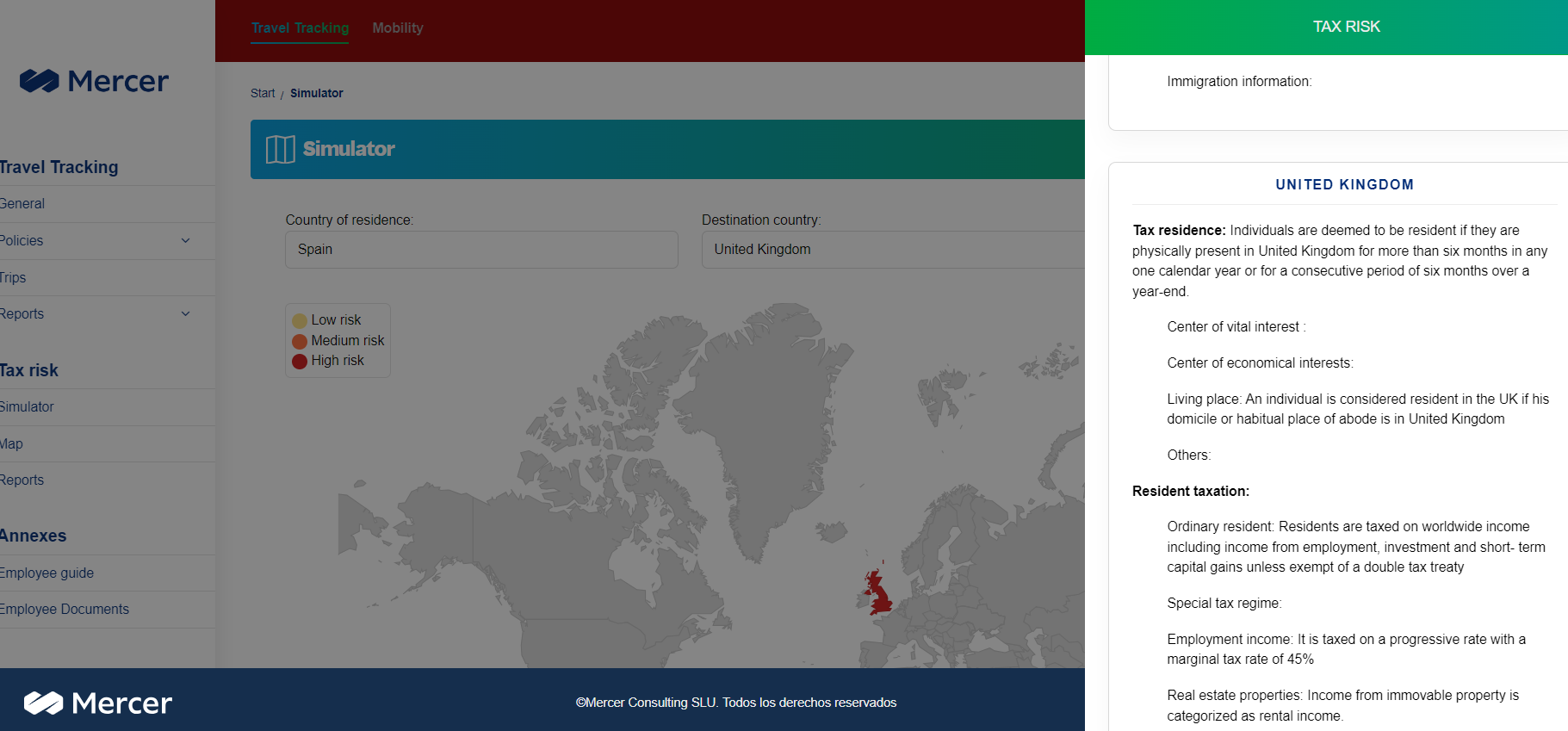

4. Tax Risk Map

This tool generates an individual dossier for each employee that enables HR to monitor actual and potential tax obligations for both the company and the employee in the assignment locations. It includes a tax risk assessment and general information about social security and immigration. Additionally, this tool lets companies simulate employer and employee tax risks in real time.